Improving Financial Literacy: Multiple Routes, One Destination

Improving Financial Literacy: Multiple Routes, One Destination

Author: Darik "DJ" Hicks

Community Involvement

Published:

Thursday, 17 Aug 2023

Sharing

Image caption: Image provided by Google Images

How many cooks can be in the kitchen? Most of us have heard of the saying: Too many cooks in the kitchen. Meaning: there are too many people working on a given project or task for it to be completed in an efficient manner. But when the project is attempting to solve the financial literacy crisis in America, is “too much” even possible?

In 2023, it is no secret that financial literacy, or the lack thereof, among U.S. adults has grown into a country-wide conversation. It is an issue many are concerned by and there is no shortage of short-term and long-term solutions being enacted to create a more financially knowledgeable nation. There are state governments putting their own legislation into place for their schools. There are college campuses creating departments and resource centers. There are for-profits and non-profits (like ours!) servicing underserved communities who are facing even steeper financial literacy mountains to climb.

Not to mention the federal government and its various agencies placing increased emphasis and strategies behind this complex dilemma. With all eyes on the problem, and hands in the pot, it’s fair to wonder if all missions and visions are aligned. Is there a common achievable goal from top to bottom in our country? Are all communities and cultures receiving the same effort? Or are we still at a point in time where any and every resource focused toward the challenge of financial literacy is needed and welcomed?

Let’s dive into a few snapshots of the different efforts taking place around the country to navigate the issue:

.png/400w/50q)

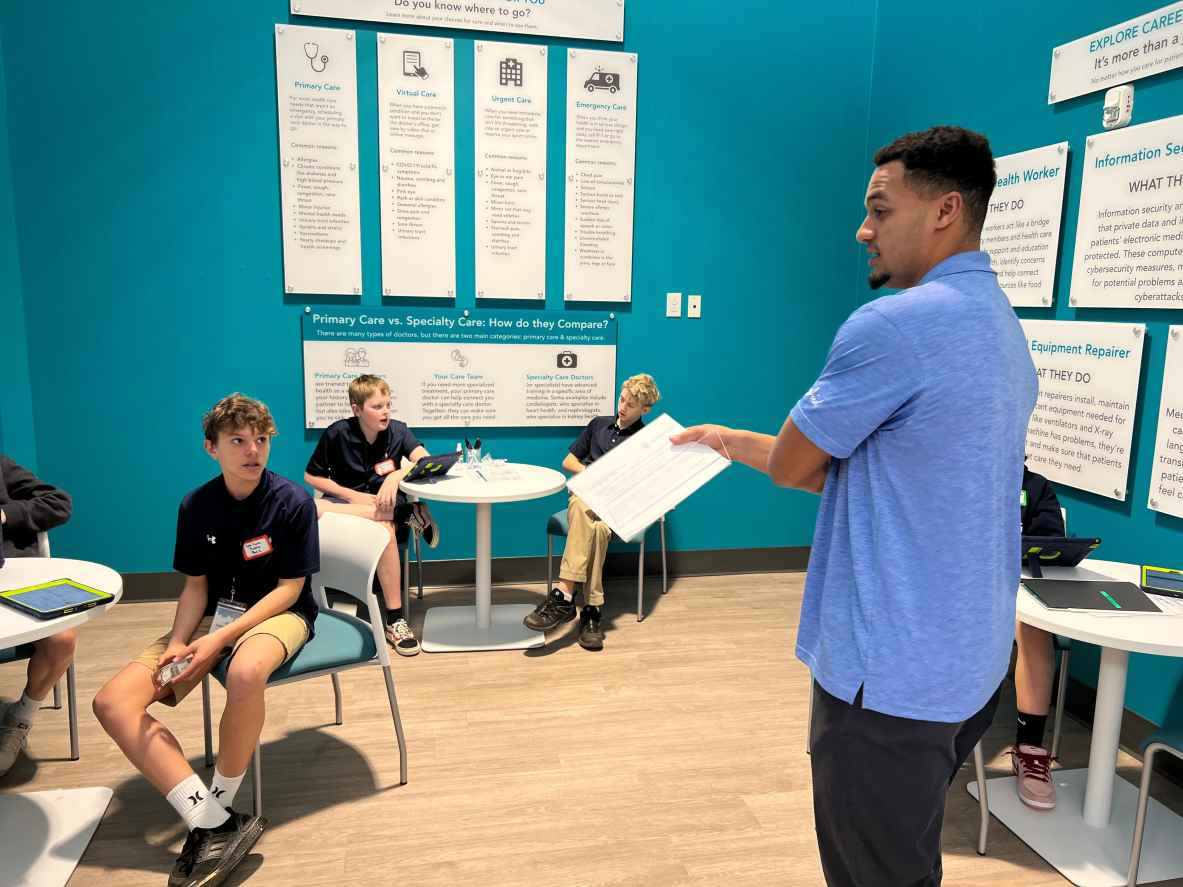

Image caption: Image provided by JA Central Carolinas

Banks Are in The Game

Financial institutions understand that the best customers are informed customers. Companies like Ally Bank, Bank of America and Varo Bank all have free resources on financial literacy and well-being. While everyone can benefit from being confident making financial decisions, this information is especially helpful for those in underserved communities to address closing the financial wealth gap.

- Ally Bank – As the title sponsor of JA BizTown at JA Central Carolinas, Ally is no stranger to making financial literacy learning fun. They provide parents and young people with a variety of games, online lessons, articles and more about achieving financial freedom.

- Bank of America – Covering topics such as investing, home ownership, credit, saving ang budgeting, Bank of America provides numerous free resources to help customers navigate life’s stages, changes and big decisions.

- Varo Bank - Varo created a free online curriculum that helps thousands of middle school students across the country gain the fundamentals of finance.

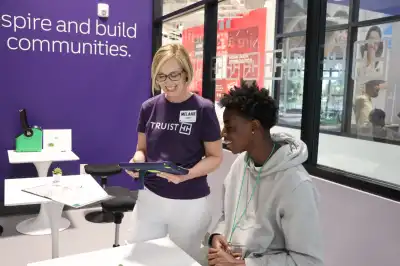

Image caption: Photo by Grant McGinnis

North Carolina Department of Education Gets Lawful

In 2019, the state of North Carolina put their own pen to paper to enact statewide financial literacy curriculum for their high school students. Beginning in the 2020-21 school year, high school students were required to coomplete one semester of financial literacy to graduate.

Are you an educator needing help making that happen? JA has the solutions, so let's work together! JA Personal Finance® and JA Financial Literacy ® both fulfill that requirement by covering topics such as managing credit, budgeting, borrowing money for large purchases, home mortgages, credit scoring and reports and planning and paying for post-secondary education.

.png/400w/50q)

Image caption: Image provided by JA Central Carolinas

The Federal Government Recognizes the Need

Even with much of the financial literacy headlines coming to the forefront over the past decade, the United States government has long recognized the need for more attention and effort to be put towards the “sustained financial well-being for all individuals and families in the U.S.” In fact, this is the vision of the Financial Literacy and Education Commission created in 2003 under the Fair and Accurate Credit Transactions Act. One of the main results and productions from this committee was the creation of the MyMoney.gov website. This website was created to be a “one-stop shop for federal financial literacy and education programs, grants and other information.” Twenty years later, the Federal Government continues to push out resources and programs for its citizens to leverage towards a healthier financial platform for all. Even just recently, the committee met with leaders from the Tribal and Native communities to focus on meeting their needs in the financial literacy and education ecosystem. Learn more about the FLEC by clicking here.

As you can see, there is no shortage of organizations, corporations and government programs pushing towards a financially literate future. While there may not be a best and only answer at the moment, a day could come in the future when greater collaboration and cohesion of efforts between all parties would benefit the country as a whole. After all, a kitchen is only as good as its best dish, Chef.

We use cookies to provide you a personalized experience. How we do this is by analyzing user behavior on our site and sharing data with our advertising and analytics partners. You consent to our cookie policy if you continue to use this website.